On December 5, 2019, the IRS released the final version of the 2020 Form W-4. The new form W-4 has been simplified to help employees reduce complexity and increase transparency. Because employees will better comprehend how to fill out the form, tax withholdings will be more accurate country-wide.

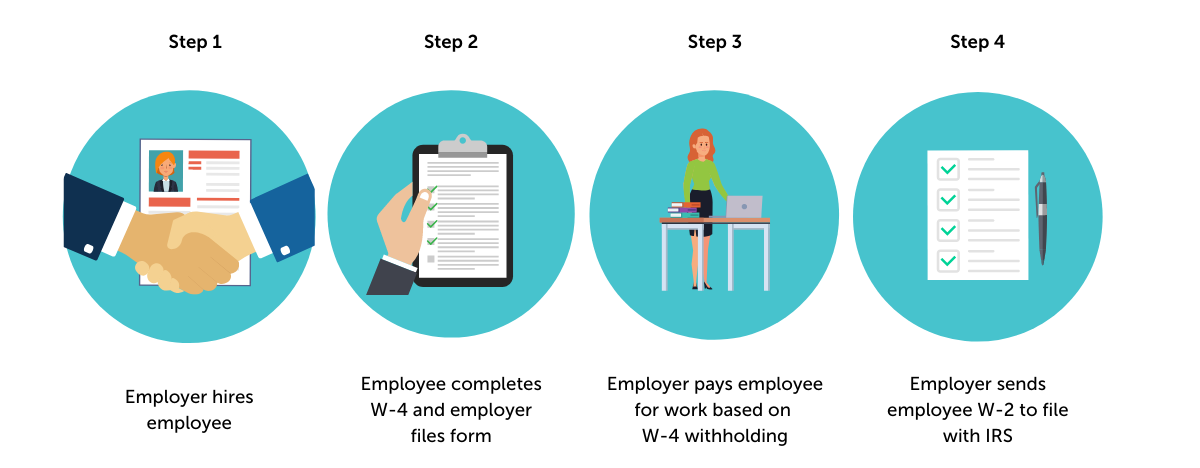

Yet, even with its reduced complexity, many employees are still wondering how to correctly fill out a Form W-4 so they can ensure the proper amount of federal taxes are withheld. Employers may also be receiving many questions from employees who are looking for guidance. So let’s take a look at the new W-4, how it’s different, and how the changes impact employees and employers.What is the Form W-4?

What’s the Difference Between a W-4 and a W-2?

How is the New W-4 Different Than the Old W-4?

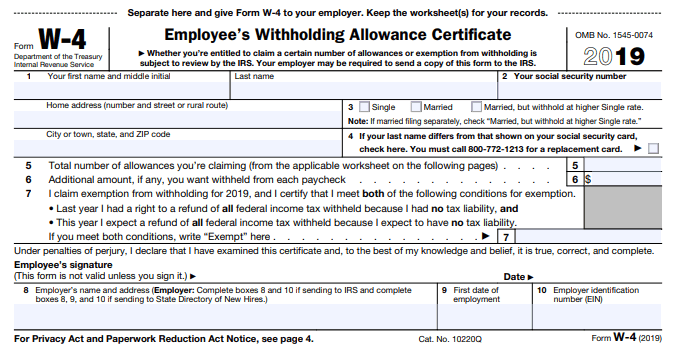

The major differences between the old Form W-4 and the 2020 Form W-4 are the use of allowances and the elimination of exemptions.

In previous years, the monetary amount that an employee was allowed to deduct on their W-4 was tied to their personal exemptions; however, with recent legislation changes, personal exemptions were eliminated from the form altogether. To compensate, individuals that previously had exemptions now are allowed greater standard deductions and higher child tax credits.

Previous Form W-4

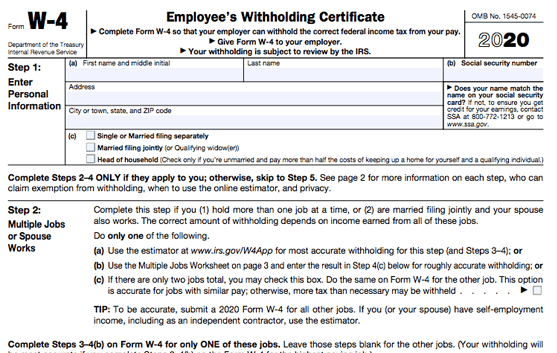

New Form W-4

How Does the New W-4 Affect Employers?

With the new W-4 format, your employees will be able to fill out the form more accurately than in previous years. This means the amount of money your employees receive in their paychecks will specifically reflect their life circumstances.

Employees that were previously confused by the W-4 and might have overpaid on their taxes now will see larger amounts of income on their paychecks, thus giving them greater satisfaction with their workplace as a whole. Happy employees lead to satisfied customers and greater business profitability.

What do Employers Need to Tell Employees About Form W-4?

Your Employers Don't Need to Fill Out a New W-4 If:

They were hired in 2019 or before 2019, they previously filled out a W-4 form, and they have no new life-changing event to add to their withholding certificate.

Your Employers Do Need to Fill Out a New W-4 If:

They were hired on January 1, 2020, or after.

They need to change their previous withholding certificate due to a new life-changing event( they got married, are filing as tax-exempt, had a baby, etc.)

How Does the New W-4 Affect Employees?

With the new W-4 format, your employees will be able to fill out the form more accurately than in previous years. This means the amount of money your employees receive in their paychecks will specifically reflect their life circumstances.

Because the new Form W-4 uses simplified text for explaining how to fill out each section, completing a W-4 is now much easier. As a result, employees can now fill out the Form W-4 more accurately, and the IRS can better evaluate each individual’s withholdings. This can keep employees from having a large tax balance due each year, or it can help prevent employees from paying too much into their taxes each year, leaving individuals with more money in their pockets.

5 Steps to Filling out the W-4 for Employees:

Step 1. Enter personal information

Step 2. Indicate multiple jobs or if the spouse works.

Step 3. Claim dependents.

Step 4. Make other adjustments including for:

4(a): Investment and retirement income.

4(b): Deductions other than the standard deduction.

4(c): Any extra tax withholding pay per period.

Step 5. Sign the form.

Steps 1 and 5 are required to be completed, while Steps 2, 3, and 4 are optional.

However, should employees opt to provide information in Steps 2, 3, or 4, their withholdings will more accurately match their tax liability.

Employees can also adjust their withholding in Step 4 (c) without sharing additional information. To help employees more accurately determine their withholding amounts, they can use the IRS Tax Withholding Estimator.

Can I Change my W-4 at Any Time?

If you find yourself needing to make changes to your W-4, you can submit a new one at any time during the year. In most cases, this will happen because you know you will be making changes to your deductions, or dependents.

An example is if you get married within that year, or you have or adopt a child. A good rule of thumb to remember when modifying your W-4 is that any adjustment made later in the year remember will have less significance on your taxes for that same year.

Change Doesn’t Need to be Scary

While change can be intimidating, the overhaul of the Form W-4 doesn’t need to be. Understanding the new format and how to properly complete a new W-4 out will ensure employees have the correct amount of taxes withheld each pay period, which means a happier workforce.

Employers need to remember that they cannot instruct their employees on what amounts to withhold from their paychecks. However, they can use this article and the IRS’ FAQs page as references when fielding employee questions about the Form W-4.

Resources for Employers

For more updates on state unemployment wage base changes, visit our SUTA Wage Bases page.

For more updates on state unemployment wage base changes, visit our SUTA Wage Bases page.

For more updates on state eligibility, visit our FUTA Credit Reductions page.

Visit our Payroll Taxes: Rates and Changes page to make sure you stay compliant.