Have you considered the impact on your business if you don’t switch payroll companies? Unfortunately, the truth is, not many of us have. Yet, according to G2’s Software Happiness Report, more than 52% of employees are unhappy at work because of their software.

Do you find yourself feeling this way about your payroll system?

Switching to a new payroll software provider can save you future headaches, time, and money. However, we often hear that businesses are hesitant to transition to a new vendor when it’s not the beginning of the year. The truth is, the middle of the year can be a great time to make a change.

So, let’s discuss some common challenges and solutions to switching providers mid-year so you can make the right decision for your organization.

Looking To Switch Payroll Software?

4 Factors to Consider When Switching Payroll Software Mid-Year

Can we agree payroll itself isn’t simple? Multiple factors are associated with a payroll process, like data integrations, employee forms, and time cards. In addition, finance directors, tax experts, HR directors, and many other employees are involved in switching systems.

However, while those factors are important, they don’t need to make or break your decision to switch providers. Instead, we’ve found the most common challenges to changing payroll systems mid-year often have logical solutions. So let’s take a look at those challenges and how you can overcome them this time of year.

Challenge#1 Data Errors

Discovering data errors in your payroll system is frustrating, especially when you’re ready to transition to a new solution. It’s crucial to fix those errors before processing your first payroll with a new provider so paychecks are accurate.

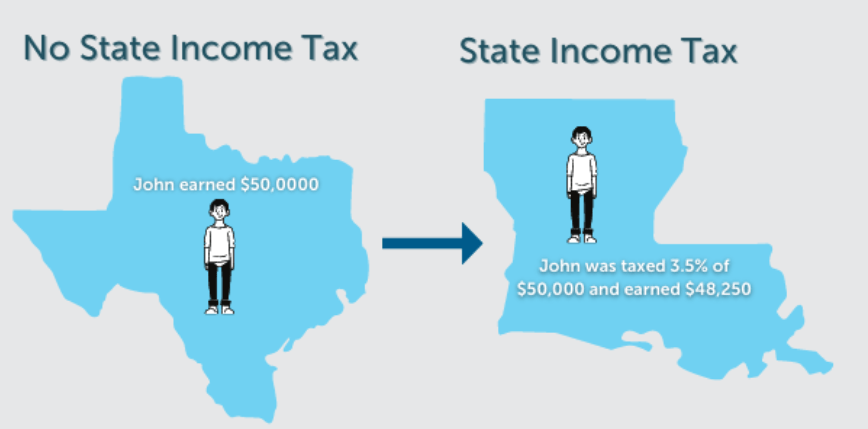

Consider this example: An employee moves from a state that doesn’t collect state taxes to one that does. If your new payroll provider handles tax filings and payments, they will need these employee data details to ensure that paychecks are issued correctly.

So how can you avoid data errors that could negatively impact your payroll process? First, consider having your previous provider perform a payroll history and assessment.

Solution: Payroll History and Assessment

Providing your new payroll vendor with a complete payroll history can proactively solve any data errors before they occur. Most records are available via a payroll summary report, which includes the full details of your previous payroll history. If this information isn’t readily available in your previous provider’s system, you can request one directly.

Once your new provider has received your payroll and tax history, they can perform an assessment. The payroll assessment helps determine the next steps in your payroll conversion process. If your provider doesn’t usually complete a payroll assessment, we’ve listed the proper steps for them to follow:

1. Tax Catch-Up

Your provider can input your tax history from your previous quarter. This tax catch-up enables a new company to check and see if everything is accurate and paid to date. If there are any errors, your provider’s tax compliance team can help you correct them.

2. Parallel Payrolls

Once your provider imports your payroll data into your new system, they can perform a parallel payroll. A parallel payroll is when you run both your old and new systems simultaneously and compare results. This process ensures the new system gathers and runs data properly before fully transitioning software.

Note: An import should occur before you run payroll in the new solution to ensure everything is processing correctly.

3. History Verification

Challenge #2: Multiple Pay Frequencies

Another reason individuals avoid switching software mid-year is that they don’t want to change company pay frequency. Pay frequency determines how often employers pay employees. It’s common for companies to utilize multiple pay frequencies across departments and teams.

Here are the most common pay frequencies:

Weekly: This payroll would be the most frequent as employees receive wages each week.

Bi-weekly: This type of pay frequency occurs every other week on the same day, such as a Friday or a Monday.

Semi-Monthly: This occurs twice a month on the same date, such as the 15th and the 30th. In February, the pay date would need to move forward.

Monthly: With this type of pay, payroll gets processed once a month, 12 times a year.

While paying employees using multiple frequencies is expected, some payroll systems limit employers to one or two frequencies. However, flexible payroll software can help you avoid frequency issues regardless of the time of year.

Solution: Payroll System Flexibility

A solution to the frequency problem is to perform due diligence when vetting payroll providers. If you need a payroll system that allows you to pay employees at different frequencies, discuss this at the beginning of your search.

Find out if the payroll solutions you’re considering will enable you to create different departments or pay groups and apply different frequencies as needed. This type of payroll system flexibility will ensure a more efficient process for employee pay.

Challenge #3: Complex Payroll Processing

“I wish I would have made the transition to APS sooner.”

These customers didn’t realize how smooth the payroll transition process could be. So, they were afraid to switch providers in the middle of the year and decided to wait until the following year.

Solution: Partner with a Better Payroll Provider Sooner than Later

- Can you handle multiple pay rates?

- Can you integrate with my existing business investments (e.g., retirement plans, general ledger packages, time tracking systems)?

- Can you easily export data from my previous solution and import it into your software?

The answer to each of these questions ensures you’re working with accurate data from day one. As a result, your business will receive a better return on investment.

Challenge #4: Complex Payroll Taxes

- Forms to file each quarter and year

- Tax payments each pay period, quarter, and year

- Legislative orders and laws to follow

- Employee documents to maintain for compliance purposes

- Year-end processing

These processes can be overwhelming and challenging to manage. However, you don’t have to wait until the beginning of the year to work with a better tax compliance partner.

Solution: Team up with Tax Experts

Switching payroll software mid-year gives you peace of mind. Instead of handling everything on your own, some payroll providers have tax compliance departments that can help you manage the complexities of payroll taxes.

Whether your payroll taxes are complex, partnering with a payroll and tax compliance provider can ultimately help your business. Their knowledge can help you maintain compliance and reduce your company’s risk.

Ensure your new provider employs APA-certified payroll tax experts who can help you file federal, state, and local taxes. Verify that they will assess your current situation to see if you have been potentially underpaying or overpaying taxes. You’ll save money by reducing potential fines and penalties.

Switching Payroll Companies Checklist

Our dedicated tax experts wanted to offer some additional tips for businesses looking to change payroll providers. These tips will help ensure you can switch payroll any time of year.

Avoid Double-Paying Taxes

Check with your previous payroll provider or tax service to see if they have already paid your unemployment taxes. If they have, you don’t want your new provider to pay it again.

Reduce Duplicate Filings

See if your new payroll provider also handles payroll taxes. If so, cancel your previous tax service to avoid duplication of filing and payments.

Remain Diligent to the End

If you plan to switch providers at the end of a quarter, know your payroll assessment period will be shorter. Your assessment gets expedited to ensure your go-live date remains the same.

However, even with a speedup in operations, your new provider can usually handle other tasks. Processes like tax catch-up and history verification are also more straightforward for the new provider to manage if you’ve already paid your taxes.

Playing Catch Up

Most payroll providers won’t file for previous quarters since this is the responsibility of your previous provider. But your new payroll provider can make sure the data from your last system is correct.

If your new provider doesn’t utilize these processes during a mid-year payroll conversion, they may not be the right fit for your company.

Now is a Great Time to Switch Payroll Systems

We understand that payroll is a complex process, and there can be many potential challenges when you’re looking to switch systems. However, mid-year is a great time to change payroll systems. Meanwhile, knowing what can arise and proactively asking your payroll vendor the right questions prepares you for a successful transition.

Whether it’s data errors or complex payroll taxes, partnering with the right provider can eliminate these challenges and the stress that comes with them. Overcoming potential hurdles paves the way for an easier and more efficient payroll transition. Furthermore, a successful payroll conversion sets your business up for long-term success.

How APS Can Help

APS has been providing payroll and tax compliance services since 1996. Therefore, our tax compliance experts can ensure your payroll information is accurate and up-to-date. Here are a few more things we do to help you along your payroll journey:

- We develop our technology in-house, which means customers drive our software developments.

- We offer a unique payroll experience with our proactive and reactive approach to support and success.

- With our all-in-one HR and payroll software, users can automate their entire tax compliance process, including W-2s, 1099s, and year-end processing.

While mid-year is a great time to change, anytime is the right time to switch to a new provider. No matter what time of year works best for you, APS is here to make your payroll and HR easier.

Click here to learn more about APS’ payroll solutions, and schedule your demo with us today!