2021-2022 ACA REPORTING

Year-end processing is quickly approaching, and with it comes Affordable Care Act (ACA) reporting. With so much information to gather, review, and account for, ACA reporting can be a cumbersome process. But it doesn’t have to be.

We wrote this article to help you navigate ACA reporting requirements once and for all. Review reporting basics and deadlines. Then check out our list of tips so you can navigate ACA and maintain compliance.

ACA Reporting Basics

ACA reporting isn’t always easy to do. You have to gather employee information and employer identification numbers. Then, there are healthcare requirements and minimum essential coverage mandates. Employers must keep track of all of this while handling multiple IRS reporting forms.

All of this can get tricky and be overwhelming, but it doesn’t have to be. Here are a few ACA reporting tips we’ve gathered to help you this year.

What is ACA Reporting?

ACA reporting refers to the information and forms employers have to gather concerning their employees’ health care coverage during the calendar year. The different types of documents needed to meet ACA reporting requirements in 2021 include:

- Form 1095-A: This is for individuals who buy their health insurance through the marketplace.

- Form 1095-B: This is for employers who offer a self-funded insurance plan to their employees.

- Form 1095-C: This is for Applicable Large Employers who offer group health plans to individuals considered full-time employees by the ACA in the previous calendar year.

Employers must file the gathered information to the Internal Revenue Service (IRS) and send copies to employees by the filing deadline to meet ACA compliance reporting requirements.

Who is Required to do ACA Reporting?

Individuals

Individuals who enroll in qualified health plans within the marketplace are required to file Form 1095-A.

Individuals

Self-insured companies with 50 or more full-time employees are required to combine 1095-B and 1095-C information into a single 1095-C form. They are also required to send covered workers copies of both their 1095-C and 1095 B forms.

Employers

Employers that offer employer-sponsored self-insured health coverage are required to file Form 1095-B. A self-funded plan like this is when an employer pays for healthcare expenses out of pocket as they are received. Though smaller businesses usually offer this, several larger organizations have adopted this insurance model recently.

Employees with 50 or more full-time employees (including full-time equivalent employees) within the previous year must file Form 1095-C. These employers file Form 1095-C because they select and purchase health plans for their employees. They must meet minimum essential requirements to offer those plans.

What is ACA Filing?

ACA filing is the process of submitting the information gathered from health reporting to the IRS. There is a variety of information included in these reports, such as but not limited to:

- Employer identification numbers (EIN)

- Taxpayer identification numbers (TIN)

- Employee dependents

- Employee addresses

- Employee and dependent months of coverage

ACA year-end reporting requirements mandate employers to send the information above in the form of returns to the IRS. Employers must also provide copies of the documents to employees as part of their ACA employer reporting requirements.

Will ACA Reporting Be Required in 2022?

Yes, employers must handle ACA reporting in 2022 for the 2021 tax season. The IRS recently released a draft form of document 1095-C. They have also posted deadlines for information filing with the IRS in 2022.

It’s good to note that each form has reporting specifics. There may even be scenarios where you’ll need to use a combination of documents during the reporting process. If you find your organization in need of ACA assistance, our team of compliance experts can help.

ACA reporting deadlines for 2022:

Due Date | Deadline |

|---|---|

January 31st* | Supply Forms 1095-C to employees.

|

February 28th | File paper Forms 1095-C with transmittal Form 1094-C.

|

March 31st | e-File Forms 1095-C with transmittal Form 1094-C.

|

What is an Applicable Large Employer?

An applicable large employer (ALE) is an employer with an average of at least 50 full-time employees. ALE’s consist of multiple organizations grouped or a single organization. If your organization is an ALE, you’re subject to the employer shared responsibility provisions and the employer information reporting requirements.

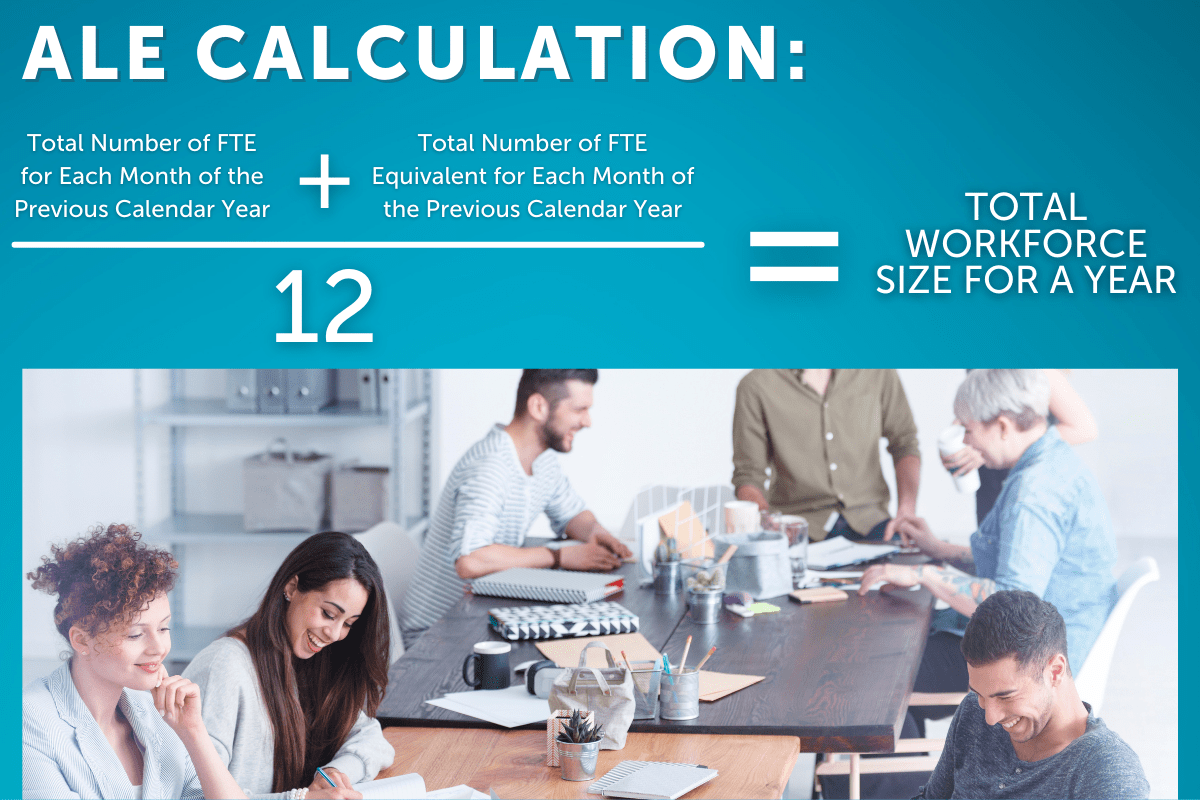

To determine your workforce size for a calendar year, add the total number of full-time employees that worked each month last year to the total number of full-time equivalent employees (FTE) that worked last year. Then, divide your total number by 12.

What’s an Aggregated ALE Group?

Aggregated ALE Group Example

- Corporation A owns 100 percent of all classes of stock of Corporation B and Corporation C.

- Corporation A has no employees at any time in 2021.

- For every calendar month in 2021, Corporation B has 40 full-time employees, and Corporation C has 60 full-time employees. Neither Corporation B nor Corporation C has any full-time equivalent employees.

- Corporations A, B, and C are a controlled group of corporations. Because of this, they get aggregated together to determine ALE status.

- Because Corporations A, B, and C have a combined total of 100 full-time employees for each month during 2021, they gain ALE status for 2022.

- Corporations B and C are each an ALE member for 2021 filing.

- Corporation A is not an ALE member for the 2021 filing because it does not have any employees during 2021.

Employers with a joint owner or otherwise related are generally combined and treated as a single employer to determine whether an employer is an ALE. However, potential liability under the employer shared responsibility provisions is determined separately for each ALE member.

What’s Minimum Essential Coverage?

Minimum essential coverage is the mandatory coverage that employers have to offer enrollees regardless of their health status or plan type. To comply with Affordable Care Act requirements, employers offer minimum essential coverage in the form of essential health benefits (EHBs). Every health plan must include the following 10 EHBs:

- Laboratory services

- Emergency services

- Prescription drugs

- Mental health/substance abuse

- Maternity and newborn care

- Pediatrics services, including oral and vision care

- Rehabilitative and habilitative services and devices

- Ambulatory patient services

- Preventive/wellness services and chronic disease management

- Hospitalization

Source: Minimum Essential Health Plans: 10 Things Your Plan Will Cover

Employers must help pay for a portion of each of these EHBs to meet the requirements for minimum essential coverage.

Looking to Automate Your ACA Reporting?

ACA 1094 and 1095 Reporting Requirements

ACA tracking and reporting requirements can be stressful if you don’t understand how they work. Form 1095-C reports information about individuals, while Form 1094-C transmits that information and employer data to the IRS.

Multiple forms can be confusing when it’s your first time handling ACA reporting compliance for your employer. Luckily, we’ve broken down the different parts of forms 1094-C and 1095-C so you can get compliant quickly and efficiently.

Preparing Forms 1095-C

Form 1095-C is the employer-provided health insurance coverage and offer form. It reports information about each employee, and it consists of two parts:

- Part I Employee and Applicable Large Employer Member (Employer): Provide general employee and employer information such as names and addresses.

- Part II Employee Offer of Coverage

- Indicate the type of coverage offered, if any, using the provided IRS codes,

- the lowest cost monthly premium for the employee, and

- the applicable safe harbor codes.

ACA Reporting Tip

Employers are required to furnish Form 1095-C to the employee only. Employees should provide a copy of this form to any family members covered under the self-insured, employer-sponsored plan listed in Part III.

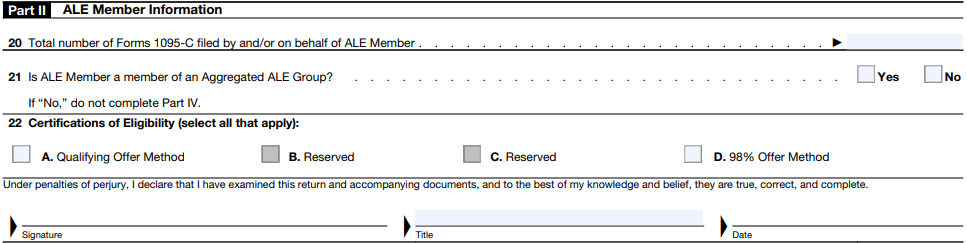

Preparing Forms 1094-C

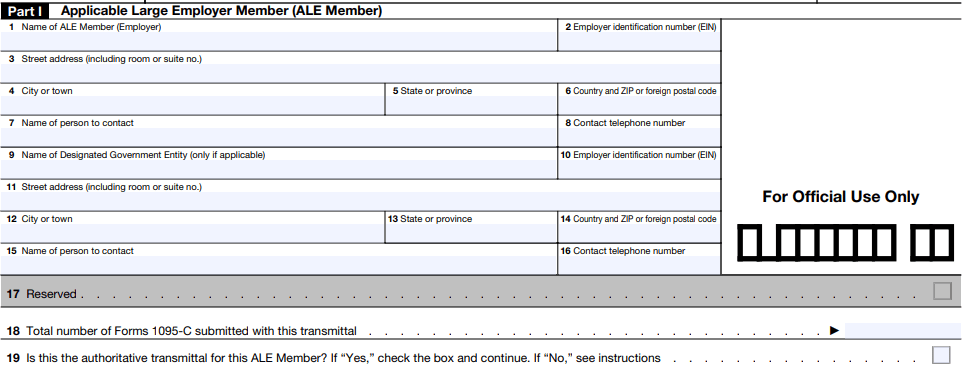

Part I Applicable Large Employer Member (ALE Member)

Part II ALE Member Information

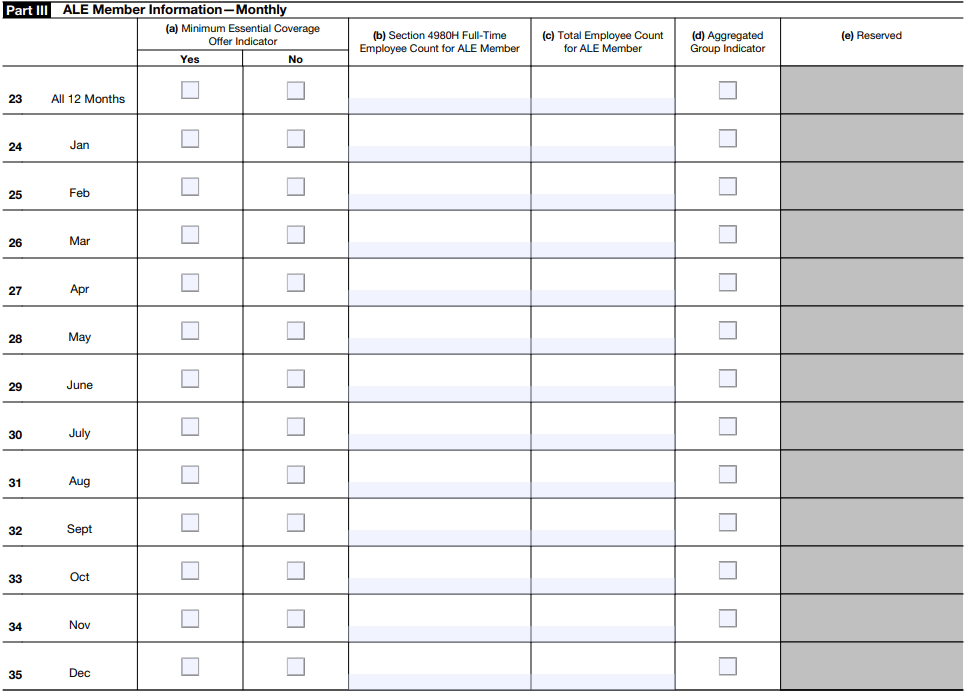

Part III ALE Member Information - Monthly

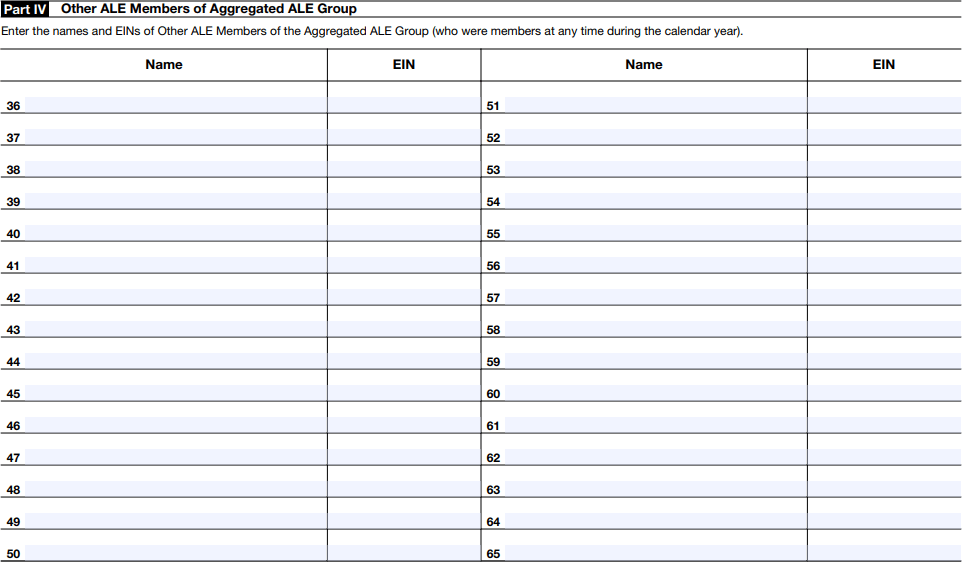

Part IV Other Members of Aggregated ALE Group

ACA Reporting Tips

Perform an ACA Audit

Run an audit on your past 1094-C and 1095-C filings during the summer for better year-end preparation. Performing an inspection can catch any errors in previous filings.

An audit ensures your organization won’t be duplicating last year’s mistakes before ACA reporting officially begins. Auditing saves your organization time and stress by proactively fixing any errors to avoid penalties.

Proactively Check for Errors

When it comes to ACA reporting, error-checking is a must. Not only are errors frustrating, but they can also cost your organization extra dollars in compliance fees. One common error we often see is when it comes to employee names. The IRS requires that employee information on Forms W-2 and Form 1095-C match their social security cards.

For example, If an employee has a hyphenated last name on their social security card but not on their Form W-2 or Form 1095-C, the IRS will count this as an error.

You can utilize your employee record and Taxpayer Identification Numbers (TIN) to correct any errors. The good news is, you don’t have to do this process manually. Specific payroll and HR providers offer an error-checking algorithm to help you automate this process.

Watch for IRS Penalties

The penalties for failure to file accurate and complete forms such as Forms 1095-C are up to $270 per return. However, if the IRS determines that failure to file was intentional, the penalty is $550 per return. This penalty is why you must file all required ACA forms by the March 31st deadline.

Tip: Consider utilizing payroll and HR software that handles e-filing with the IRS on your behalf. Providers who offer these features help automate your ACA reporting and eliminate IRS penalties.

Be Aware of ACA Reporting Extensions

If you plan to file for an ACA reporting extension, make sure you set a deadline that gives you ample time to apply. To apply for an ACA reporting extension, you’ll need to submit Form 8809 before the required return due date.

Tip: Be prepared to have a reason for why you’re extending, as you’ll have to check your reasoning on the form.

Review Your ACA Strategy

If your company is subject to the Employer Mandate, start reviewing your current ACA strategy. Then, determine what method of section 6056 reporting you plan to use. To meet ACA reporting requirements for 2021 and in the years following, it’s crucial to approach it with a team effort, aligning HR, finance, and your company’s accountant or tax advisor.

A unified system that accurately tracks and records coverage provided for full-time employees every month will better prepare you for year-end processing.

When reviewing your current ACA strategy, consider the following:

Does your organization qualify as an ALE according to the guidelines of the Employer Mandate?

Do you have systems in place to accurately track and manage ACA compliance, including employee statuses, benefits administration, and variable hour employee tracking?

What reporting method works best for your organization?

Have you recently reviewed the IRS page on ACA reporting to ensure you’re up to date on reporting guidelines?

Work With an ACA Compliance Reporting Partner

Automatic reporting of employer-sponsored coverage amounts on Form W-2s.

A full-time equivalent calculation to determine if your organization is an applicable large employer.

Management of marketplace notices to employees.

Management of part-time employees’ hours with alerts for anyone who has exceeded their allowed hours of service for the week.

Benefit enrollment tracking to ensure applicable employees are covered.

Reporting to decide which employees are eligible for health coverage.

Dashboard views to manage measurement periods and receive ACA alerts.

Annual reporting with pre-populated 1094-C and 1095-C forms and e-filing on your company’s behalf.

Work With an ACA Compliance Reporting Partner

APS offers ACA compliance and reporting services that make this complex requirement easier. We help you populate and complete Forms 1095-C. Our error-checking algorithm ensures codes are valid and data is formatted correctly for reporting.

Our four-step guided reporting process accurately captures and reports health plan coverage information to the IRS with pre-populated forms. We provide a worry-free way to meet ACA reporting requirements for 2021 and avoid penalties. We’ll even e-file with the IRS on your behalf.

Disclaimer: This blog does not serve as tax or legal advice. Consult the Internal Revenue Code laws set by the IRS and your local tax authority before making any decisions regarding your ACA Reporting.

This blog is for informational purposes only and subject to change. Automatic Payroll Systems, Inc. makes no express or implied warranties concerning this document or any statements contained herein and expressly disclaims any warranties, including those for a particular purpose.