The Difference Between a W-2 and Final Pay Stub

It’s that time of year when employers and HR departments start preparing for the upcoming tax season. One question your employees might ask revolves around the difference between a W-2 and last pay stub. When employees receive their W-2s, they sometimes notice a difference between their last pay stub and what’s written on their W-2 form.

Whether you’re new to payroll taxes or a seasoned payroll veteran, this topic can be confusing to navigate. But, if you’re going to help your employees this tax season, you must comprehend gross pay vs. W-2 wages. We’ve created this article to help you understand the difference between a pay stub and a W-2, so you can help your employees navigate tax forms successfully.

Is a W-2 the Same as a Pay Stub?

No, a W-2 is not the same as a pay stub. A W-2 form, also known as a Wage and Tax Statement, is a required document that an employer must send to employees each year. Once an employee elects their preferred withholdings like healthcare and 401(k) contributions, the employer must send a receipt of that information to the Internal Revenue Service (IRS) for reporting purposes. Think of your employees’ W-2 as a net earnings pay stub.

A pay stub outlines the details of an employee’s gross wages for each pay period. Employers are not required to send pay stubs to employees. However, the Fair Labor Standards Act requires employers to track employees’ work hours.

A pay stub is typically attached to an employee’s physical paycheck. Certain payroll providers also offer paperless payroll, allowing employees to access pay stubs online.

Does Your Workforce Have W-2 Questions?

Why is My W-2 Different from My Salary?

The compensation may be different on a W-2 vs. a final pay stub, but here’s why. Your salary is a gross dollar amount earned before taxes and deductions. Meanwhile, your Form W-2 shows your taxable wages reported after pre-tax deductions.

Pre-tax deductions include employer-provided health insurance plans, dental insurance, life insurance, disability insurance, and 401(k) contributions. That’s why your W-2 doesn’t match your last pay stub.

Pay Stubs | W-2 |

|---|---|

Gross Dollar Amount of Salary | Taxable Wages Reported |

Before Taxes | After Pre-Tax Deductions Get Taken Out

(Health insurance, Life Insurance, 401(k), Disability insurance) |

Unless you opt out of pre-tax deductions, your salary amount will almost always be higher than wages reported on your W-2. To clarify which pre-tax deductions you are opted in to, check Box 1 of your W-2. If you are confused about your Box 1 deductions, our blog Pre-Tax and Post-Tax Deductions: What’s The Difference can help clarify details related to these withholdings.

Reasons Why the Gross Amount on Your End-of-Year Pay Stub may be Different Than the Amount on Your W-2

APS receives many questions during tax season, and the one that comes up most often is, “Why doesn’t my W-2 match my pay stub?” or “Why doesn’t my W-2 match my salary?” It is typical for gross taxable wages on an employee’s final pay stub of the year to differ from the amount shown on their Form W-2. This difference is a result of the following reasons:

1. Year-End Pay Stubs Include Non-Taxable Income Items

Examples of non-taxable income items include reimbursements for mileage or other non-taxable expenses. These non-taxable items are paid back during payroll runs. As a result, the gross wages on an employee’s pay stub often differ from Boxes 1, 3, 5, and 16 wages on the W-2 because these non-taxable items will lower gross taxable wages.

Example

Mary’s gross wages are $30,000, but she received $2,000 towards a non-taxed car allowance over the year. Mary’s taxable W-2 wages will be $28,000.($30,000 – $2,000 = $28,000)

2. Company-Sponsored Retirement Plan Participation

Company-sponsored retirement plans like 401(k)s reduce taxable federal and state wages only. They are reported in Boxes 1 and 16, respectively. If you contribute to a retirement plan, the compensation on your end-of-year pay stub vs. your W-2 will differ.

Example

Sally’s gross wages are $30,000, but she contributed $3,000 towards her 401(k) retirement over the year. Sally’s federal and state W-2 wages will be $27,000.($30,000 – $3,000 = $27,000)

3. Company Health Insurance is a Pre-Tax Deduction

Company health insurance is the most common reason your last pay stub does not match your W-2. If your company offers pre-tax health insurance and you have participated, then the taxable wages in Boxes 1, 3, 5, and 16 will be lower than the amount of the pre-tax health insurance deduction. Pre-tax deductions will lower the gross wages by the annual amount of the deduction.

Example

John’s gross wages are $30,000, but he contributed $2,000 to a pre-tax health insurance deduction over the year. John’s taxable W-2 wages will be $28,000.($30,000 – $2,000 = $28,000)

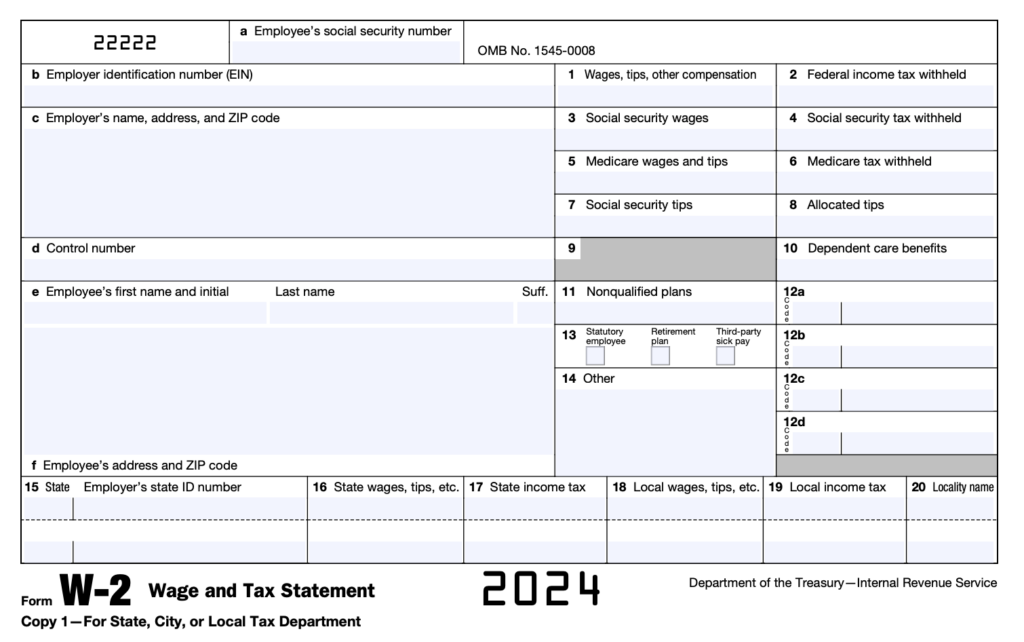

What are the Boxes on a W-2?

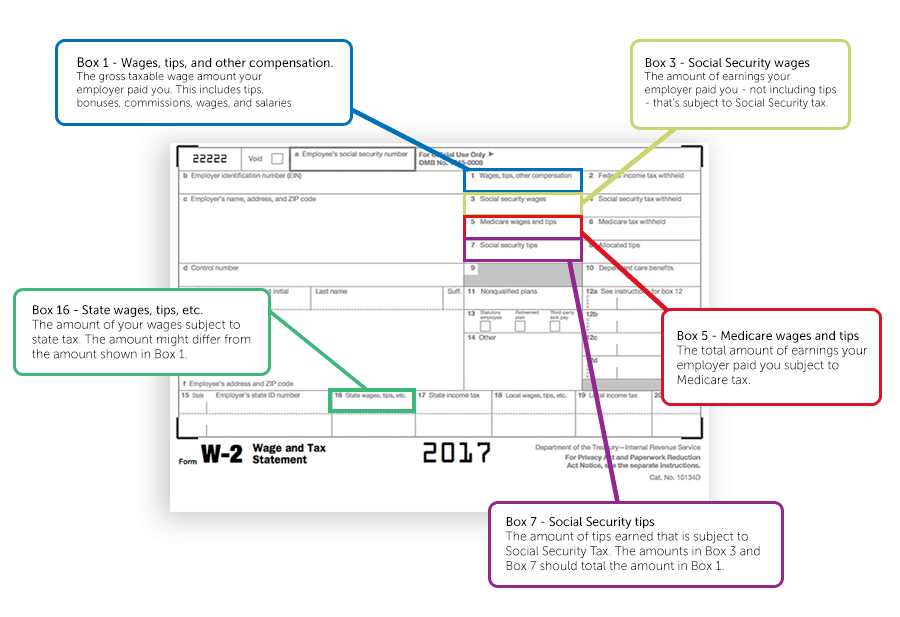

Box 1: Wages, Tips, and Other Compensation

Box 1 shows the amount of gross taxable wages an employer paid. These wages include tips, bonuses, commissions, and salaries. This part of Form W-2 doesn’t include amounts given to retirement plans or other payroll deductions. Because it subtracts other deductions, it’s often less than the amounts shown in Boxes 2 and 3. Therefore, it’s often the number employees care about most.

Box 2: Federal Income Tax Withheld

Box 2 shows the Federal income tax withheld from your pay during the previous calendar year. The W-4 you fill out each year determines this tax withholding rate. If your employees find their tax number too high or low, encourage them to adjust their Form W-4.

Box 3: Social Security Wages

Box 3 includes the number of earnings your employer paid you – not including tips – subject to Social Security tax. The number in this box doesn’t consider pretax deduction items that reduce overall taxable income, which means Box 3 could be higher than the amount shown in Box 1.

However, if you or your employee are high-income earners, this box could be less than the total amount in Box 1. That’s because there is a maximum amount of wages Social Security can tax high-income earners. The maximum Social Security tax for high-income earners in 2022 is $147,000.

Box 4: Social Security Tax Withheld

This amount represents the total social security taxes withheld from your wages. Box 4 gets calculated as 6.2 percent of the Social Security wages in Box 3. You shouldn’t have more Social Security withholding than the maximum wage base x 6.2%.

Box 5: Medicare Wages and Tips

Medicare wages and tips are the total amount of earnings you make that are subject to Medicare tax. These taxes don’t usually subtract pre-tax deductions and include taxable benefits like bonuses and vacation. There also isn’t a cap on Medicare taxes, which means the number in Box 5 can be significantly larger than what’s shown in Box 1 or Box 3.

Box 6: Medicare Tax Withheld

Medicare tax withheld represents the amount Medicare took from your wages to go to taxes. Both Social Security and Medicare taxes come from a flat rate. The rate is usually 1.45% percent of the total Medicare wages in Box 5.

An easy formula for this is Box 6 = Box 5 x 1.45%. However, employees who earn more than $200,000 (single) or $250,000 (married filing jointly) are also subject to an additional 0.9 percent Medicare tax.

Box 7: Social Security Tips

This box represents tips subject to Social Security Tax. If this box is blank, you didn’t report any tips earned to your employer. However, unreported tips are still taxable. The amount in this box and Box 3 should total the amount in Box 1.

Box 8: Allocated Tips

This box shows the tip income your employer allocated to you. W-2 boxes 1, 3, 5, or 7 don’t include this amount. To learn more about tip income, click here.

Box 9: Verification Code

Employers who participate in the pilot IRS Verification Initiative use this box. It applies only to electronically filed returns and is a part of a new plan to combat tax identity theft and refund fraud.

You and your employees might have a 16-digit verification code listed in Box 9. If you see this code, you or your tax provider should enter it when prompted by tax filing software. If Box 9 is blank and you don’t have this code, don’t worry. Even if you aren’t a part of the pilot program, your tax return will still get accepted.

Box 10: Dependent Care Benefits

Box 10 lists the total amount paid into your dependent care flexible spending account for the year. Any amount over $5,000 is included in Box 1 as well.

Box 11: Nonqualified Plans

This box shows the total amount distributed to you from your employer’s nonqualified deferred compensation plan. It’s good to note this amount is taxable, and it is not to be confused with the amounts listed in Box 12. Box 11 is distributed to you, while Box 12 gets distributed by you.

Download the Year-End Payroll Guide

Want to take it with you? Download our convenient guide to make your year-end payroll processing easier.

Box 12: Compensation and Benefits

(Click to see the codes included)

This box is used to indicate a compensation or benefit by code. These codes include:

A — Uncollected Social Security or RRTA tax on tips. Include this tax on Form 1040.

B — Uncollected Medicare tax on tips. Include this tax on Form 1040.

C — Taxable cost of group-term life insurance over $50,000 (included in boxes 1,3 (up to Social Security wages base), and box 5.

D — Elective deferrals to a section 401(k) cash or deferred arrangement. It also includes deferrals under a SIMPLE retirement account, part of a 401(k) arrangement.

E — Elective deferrals under section 403(b) salary reduction agreement.

F — Elective deferrals under a section 408(k)(6) salary reduction SEP.

G — Elective deferrals and employer contributions (including non-elective deferrals) to a section 457(b) deferred compensation plan.

H — Elective deferrals to a section 501(c)(18)(D) tax-exempt organization plan.

J — Nontaxable sick pay (information only, not included in Boxes 1, 3, or 5).

K — 20% excise tax on excess golden parachute payments.

L — Substantiated employee business expense reimbursements (nontaxable).

M — Uncollected Social Security or RRTA tax on taxable cost of group-term life insurance over $50,000 (former employees only).

N — Uncollected Medicare tax on taxable cost of group-term life insurance over $50,000 (former employees only).

P — Excludable moving expense reimbursements paid directly to a member of the U.S. Armed Forces (not included in Boxes 1, 3, or 5).

Q — Nontaxable combat pay. See the instructions for Form 1040 or Form 1040A for details on reporting this amount.

R — Employer contributions to your Archer medical savings accounts (MSA). Report on Form 8853, Archer MSAs, and Long-Term Care Insurance Contracts.

S — Employee salary reduction contributions under section 408(p) SIMPLE plan (not included in Box 1).

T — Adoption benefits (not included in Box 1). Complete Form 8839, Qualified Adoption Expenses, to compute any taxable and nontaxable amounts.

V — Income from exercise of non-statutory stock option(s) (included in Boxes 1, 3 (up to Social Security wage base), and 5). See Publication 525, Taxable and Nontaxable Income, for reporting requirements.

W — Employer contributions (including amounts the employee elected to contribute using section 125 (cafeteria plan) to your health savings account (HSA). Report on Form 8889, Health Savings Accounts (HSAs).

Y — Deferrals under section 409A nonqualified deferred compensation plan.

Z — Income under a nonqualified deferred compensation plan that fails to satisfy section 409A. This amount is also included in Box 1 and is subject to 20% tax plus interest. See the Form 1040 instructions.

AA — Designated Roth contributions under a section 401(k) plan.

BB — Designated Roth contributions under a section 403(b) plan.

DD — Cost of employer-sponsored health coverage. The amount reported with Code DD isn’t taxable.

EE — Designated Roth contributions under a governmental Section 457(b) plan. This amount doesn’t apply to contributions under a tax-exempt organization Section 457(b) plan.

FF — Permitted benefits under a qualified small employer health reimbursement arrangement.

Box 13: Retirement Plan

This box is checked when an employee is an active participant in a retirement plan.

Box 14: Other

- State disability insurance taxes withheld

- Union dues

- Uniform payments

- Deducted health insurance premiums

- Nontaxable income

- Educational assistance payments

- A member of the clergy’s parsonage allowance and utilities

Box 15: Employer’s State ID Number

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Box 16: State Wages, Tips, Etc.

Box 16 represents the number of your wages subject to state tax. The amount might differ from the amount shown in Box 1. This box will remain blank if you don’t live in a state with income taxes.

Box 17: State Income Tax

If you reported wages in Box 16, then Box 17 will show the amount of state taxes withheld from you and your employee’s income. If you live in a state with a flat state tax, it’s good to double-check withholdings by multiplying the amount in Box 16 by that state’s tax rate.

Here is a list of states with flax tax rates.

State | Flat Tax Rate* |

|---|---|

Pennsylvania | 3.07% |

Indiana | 3.23% |

Michigan | 4.25% |

Colorado | 4.55% |

Illinois, Utah | 4.95% |

Kentucky, Massachusetts, New Hampshire | 5% |

North Carolina | 5.25% |

*Note: Rates have been updated as of 2022 but are subject to change.

Box 18: Local Wages, Tips Etc.

If you or your employees live in an area subject to local, city, or other state income taxes, those wages get reported here. When employees have wages subject to withholding in more than two states or localities, you need to provide them with an additional W-2 form.

Box 19: Local Income Tax

Any taxes withheld on the wages in Box 18 get reported in Box 19.

Box 20: Locality Name

Box 20 is where you put the name of the local area, city, or other state tax reported in Box 19.

About APS

- We automate the management of incomes and deductions during payroll processing to ensure accurate withholdings and paychecks.

- Our secure, centralized database stores and tracks required tax forms for employees for better payroll and tax compliance.

- Our Analytics and Reporting solution provides employee classification reports so that you can maintain compliance.

- Our payroll and tax compliance experts file federal, state, and local tax filings and payments as the reporting agent on your behalf.

- We provide wage garnishment services, including calculating and processing garnishment orders, so you don’t pay unnecessary penalties.

- Our built-in W-2 error-checking algorithm and validation rules allow you to review incomes and deductions before processing payroll to ensure accuracy.

- Our tax compliance department helps you with other tax regulations saving you time and money.