The Difference Between W-2 and 1099 Forms

Each year, employers issue W-2s and 1099s to their employees. However, often HR managers get asked about the difference between these two forms. If you’re a recruiter or a hiring manager, understanding the difference between these two forms is the first step to hiring the right talent for a position.

Providing the wrong form to an employee could result in potential fines. To avoid this issue, let’s look at the differences between Form W-2 and Form 1099. We’ll focus on forms 1099-MISC and 1099-NEC as those are most applicable to employers. Finally, we’ll look at how to determine which form to use so you can recruit the right talent and maintain compliance during year-end processing.

Everything Employers Need to Know About W-2 Forms

Any business owner engaged in a trade or business who pays for services performed by an employee must file a Form W-2 for each employee. Earnings include non-cash payments of $600 or more for the year. Here are some essential facts to know about W-2 forms:

- It’s different from a Form W-4, which tells employers how much tax to withhold from employee paychecks each pay period.

- It usually determines whether a person receives a refund or pays during tax season.

- Employers must provide their employees with copies of their W-2s by the end of January each year.

From the first paycheck to the final payroll processed, that information populates Form W-2s. Form W-2s give employees an overview of their earned wages, any taxes withheld, and any deductions taken for items like retirement contributions or health insurance for that calendar year.

NOTE: Sometimes, the amounts shown on a Form W-2 are different than what’s reflected in a final pay stub for the calendar year. If this is the case, you can utilize a resource like our W-2 Vs. Final Pay Stub Handout to explain the difference to your employees.

What is Form W-2?

Form W-2 is the tax form used to report payments made to employees for the year. Employers must provide a W-2 to each employee and the IRS at the end of each year. Form W-2 includes information about the tax year, including:

- Taxable Income: How much an employee made and how much of that income is withheld for federal taxes.

- Social Security and Medicare Income: How much money employers withhold to pay FICA taxes.

- State Income: How much is withheld for state income taxes if any.

For employees, the information provided on a W-2 is necessary to file an income tax return each year. In addition, employees can utilize this form to determine how much they owe the IRS or receive via a tax refund.

Employers will also file Copy A of their employees’ W-2s with the IRS, along with a Form W-3, Transmittal of Wage and Tax Statements, to fulfill their tax filing obligations.

Note: If employees misplace their W-2, encourage them to visit the IRS website to get a copy of their W-2.

Who Gets a Form W-2?

Form W-2 goes to any employee who earns at least $600 from an employer. Employers are required by law to file copies of W-2s to the IRS, Social Security Administration (SSA), and state and local tax authorities, if applicable.

Employers typically begin verifying employee information in October and November to prepare for year-end processing and the distribution of W-2s to employees. The type of information to verify includes:

- Social security numbers

- Employee names

- Employee addresses

Once this information has been verified or corrected, employers then prepare to generate W-2s to distribute in January. If an employer uses a provider that offers payroll tax compliance services, this process can be as simple as making W-2s available to employees in an online portal for easy access.

If an individual receives at least $600 from more than one employer, they must file all Form W-2s. If an employee only worked for an employer part of a calendar year, they must file that Form W-2 with the IRS.

Reporting W-2 Income for Employees

Employers must report employee incomes, deductions, and employer payments to the proper tax authorities. To do so, you must withhold income tax and the employee portion of Social Security and Medicare taxes. Both employees and employers are subject to Medicare taxes and Social Security.

The Social Security rate is 6.2% for the employer and 6.2% for the employee, or 12.4% total. Conversely, the Medicare tax rate is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Employers are responsible for paying Social Security, Medicare, and unemployment (FUTA) taxes on employee wages.

Everything Employers Need to Know About 1099s

A Form 1099 shows that a nonemployer entity paid money to an individual. There are many different 1099 forms. They vary from interest and dividends to pensions and payouts from personal retirement accounts. Here are some essential facts to know about 1099 forms:

- Receiving a 1099 form doesn’t necessarily mean an individual owes taxes on that money.

- Employers must provide copies of Form 1099 to contractors or freelancers by the end of January each year.

- Employers must file Form 1099 with Form 1096, Annual Summary, and Transmittal of U.S. Information Returns.

Two of the most common 1099s are the 1099-NEC and 1099-MISC. These forms are typically issued to independent contractors or freelancers to report their wages without taxes withheld, like Medicare and Social Security, to the IRS.

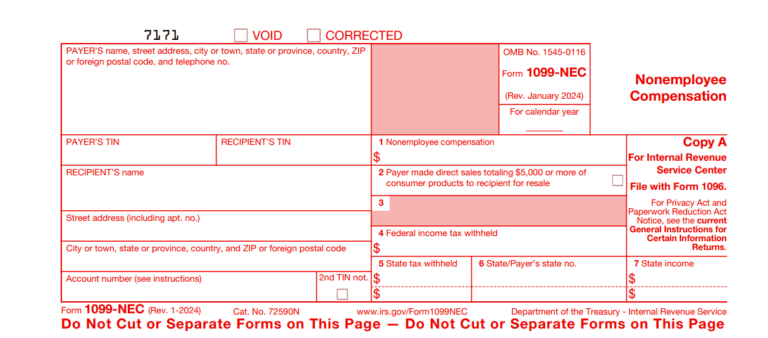

What is Form 1099-NEC?

Last year, the IRS shifted from the 1099-MISC to Form 1099-NEC for non-employee compensation reporting. As a result, businesses would need to use the new Form 1099-NEC if they made payments to nonemployees totaling $600 or more.

Before 2020, payments made to nonemployees would show on Box 7 of the 1099-MISC. However, the IRS reintroduced Form 1099-NEC to clarify filing deadlines. Instead of dealing with multiple 1099-MISC filing deadlines, the 1099-NEC has a single filing deadline for all payments used.

Who Gets a Form 1099-NEC?

Any individual who earns at least $600 from a business that does not count them as an employee must receive a Form 1099-NEC for tax purposes. In addition, employers are required by law to file copies of 1099s to the IRS, Social Security Administration (SSA), and state and local tax authorities, if applicable.

Employers typically begin verifying information in October and November to prepare for year-end processing and the distribution of 1099s to contractors and freelancers. The type of information to verify includes:

- Social security numbers

- Contractor names

- Contractor addresses

Once this information has been verified or corrected, employers then prepare to generate 1099s to be distributed in January. If an employer uses a provider that offers payroll tax compliance services, this process can be as simple as mailing 1099s directly to contractors for added convenience.

Reporting Income for 1099-NEC Workers

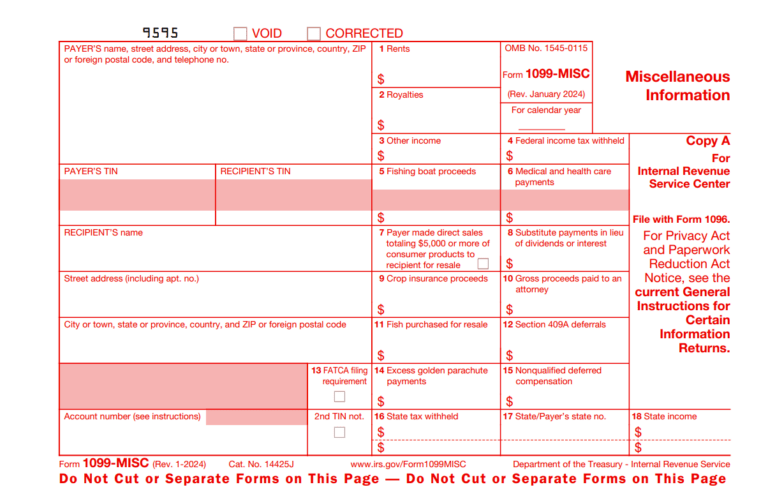

What is Form 1099-MISC?

Before 2020, Form 1099-MISC, also known as the miscellaneous income form, was used to report income besides regular employee wages. However, in 2020 the usage of Form 1099-MISC changed. This form is now only used for alternative miscellaneous fees. Those payments must be at least $600 towards the following:

- Rents

- Prizes and awards

- Other income payments

- Medical and health care costs

- Crop insurance proceeds

- Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish

- Generally, the cash comes from a notional principal contract to an individual, partnership, or estate

- Payments to an attorney

- Any fishing boat proceeds

Now that Form 1099-NEC reports non-employee compensation, Form 1099-MISC and the box numbers on it report certain other incomes:

- Box 7 – Payer made direct sales of $5,000 or more

- Box 9 – Crop insurance proceeds get here

- Box 10 – Gross proceeds to an attorney get here

- Box 12 – Section 409A deferrals get here

- Box 14 – Nonqualified deferred compensation income gets reported here

- Boxes 15, 16, and 17 – State taxes withheld, state identification number, and the amount of income earned in the state gets reported in these boxes

NOTE: The due date for filing Form 1099, including non-employee compensation, has changed from February 28th to January 31st. Furthermore, there is no longer an automatic 30-day extension for forms that include NEC.

Important W-2 and 1099 Deadlines

Deadline to Send Forms to Employees & Contractors | Deadline to File W-2 With Social Security Administration | Deadline to File 1099 MISC with Social Security Administration |

|---|---|---|

January 31, 2024 | January 31, 2024

*Employers should file forms along with a W-3 transmittal | January 31, 2024

*Employers should file forms along with a 1096 transmittal |

The Difference Between a 1099 and W-2 Employee

Types of 1099 Workers

You can provide 1099s to several different types of workers. Knowing the difference between these workers can help you in your recruiting process. It will also help you maintain compliance when distributing tax forms each year.

Here is a list of the most common types of 1099 workers and how they differ from each other:

- Freelancers: These individuals often work with organizations on a per-project basis. Some freelancers work with more than one business at a time, maximizing their earning potential. In addition, they often choose when they can and can’t work and set their rates.

- Consultants: Like freelancers, these individuals are self-employed. However, the difference lies in their skillset. Often, these individuals have unique or highly crafted experiences, education, and training that make their knowledge invaluable. Their knowledge often leads to opportunities to help companies strategize on an as-needed basis. These workers usually demand high compensation for their time and efforts.

- Independent Contractors: Independent contracts are similar to freelancers. However, they often prefer long-term contracts instead of short, one-off projects. Most independent contractors get paid by the hour, but sometimes they have a retainer agreement with an organization.

- Gig Worker: These individuals are similar to freelancers; however, their offering and payout differ. Usually, these workers opt to perform small jobs. As a result, they often are paid per task completed.

- Contractor: Similar to an independent contractor, a contractor is also self-employed. However, they often choose to find long-term work through an agency or company. This workflow could be similar to a W-2 employee, where the contractor reports to a manager and receives regular payouts.

What’s the Difference Between an Employee and W-2 Worker?

Employees are usually W-2 workers. However, some employers with long-term agreements might internally refer to these workers as employees.

How you’re classifying your employees and independent contractors determines which form you’ll use. To better understand this process, let’s look at how the IRS classifies workers. According to the IRS, an employee is anyone who performs services for you if you can control what tasks occur and how they get executed.

For example, if a worker performs tasks on a full-time basis, requires minimal assistance due to experience, and their work is subject to a supervisor’s approval, that person is an employee.

The IRS defines an independent contractor as anyone who offers their services to the general public. This definition includes doctors, dentists, lawyers, and accountants. If the payer has the right to control or direct the work’s result and not what gets done or how it’s performed, that worker is an independent contractor. However, distinguishing whether a worker is an employee or an independent contractor depends on each case’s facts.

How to Determine if a Worker is an Employee or Independent Contractor

Accurately classifying employees and contractors is vital for federal tax purposes. Worker classification impacts how you pay employer taxes and how your employees pay theirs.

To determine the classification of your employees, the IRS has provided questions to ask so you can maintain compliance. Here are the three categories the IRS looks at when making employment classifications:

1. Behavioral Control

Behavioral control demonstrates whether you have the right to direct or control how workers complete their tasks. If a business has a right to direct or control task completion, the worker gets classified as an employee. The employer does not have to handle how the work gets done, as long as they own the work itself. Behavioral control falls into the following categories:

Type of Instructions Given

If the worker receives extensive instructions on completing the work, that person may be an employee. Instructions can include:

- When and where to do the work

- What tools or equipment to use

- What workers to hire or to assist with the work

- Where to purchase supplies and services

- What work must be performed by a specified individual

- What order or sequence to follow when performing the work

If the worker receives less extensive instructions about the tasks to complete and more critical information on how to complete the job, the worker may be an independent contractor. For example, time and place may be less important than how the actual work gets performed.

However, the amount of instruction will vary depending on the work performed. Even if an employer gives no instructions, behavioral control may exist if the employer has the right to control how the individual achieves the work results.

Degree of Instruction

If the worker receives less extensive instructions about the work to complete but not how it should be done, the worker may be an independent contractor. For example, time and place may be less important than how the actual work is performed.

However, the amount of instruction will vary depending on the type of work performed. Even if an employer gives no instructions, behavioral control may exist if the employer has the right to control how the individual achieves the work results.

Evaluation System

Training

2. Financial Control

Financial control refers to facts that determine whether or not an employer has the right to control the economic aspects of the worker’s job. Financial control factors include the following categories:

Significant Investment

Independent contractors often invest significantly in the tools and equipment they use when working for someone else. However, there are certain occupations where workers spend their own money on equipment and are still considered employees.

There is no specified dollar amount to meet to have a significant investment. In addition, some work types do not require large expenditures, so substantial investment is unnecessary for independent contractor status.

Unreimbursed Expenses

Opportunity for Profit or Loss

Services Available to the Market

Method of Payment

An employee is usually guaranteed a regular wage amount for an hourly, weekly, or another period. This reoccurring wage payment generally indicates that a worker is an employee, even when a commission supplements the wage or salary.

An independent contractor is typically paid a flat fee for the job. However, it is common in some professions to pay independent contractors hourly.

3. Type of Relationship

Type of relationship refers to facts about how the worker and employer perceive their relationship. These factors include the following categories:

Written Contracts

Employee Benefits

Permanency of Relationship

If the expectation is for a worker-business relationship to continue indefinitely, this is typically considered evidence that the intent was to create an employer-employee relationship.

Work relationships with a defined amount of time or a specific project could indicate the worker is an independent contractor.

Services Provided as Key Activity of the Business

If a worker provides services that are a crucial aspect of the business, it is more likely that the employer will have the right to direct and control their activities. For example, if a company hires a graphic designer, it is expected to present the designer’s work as its own and have the right to control or direct that work. Therefore, this factor would indicate an employer-employee relationship.

To better understand how this process works, consider diving into how the IRS classifies workers.

Additional 1099 and W-2 Resources

If it is still unclear whether a worker is an employee or independent contractor after reviewing these three categories of facts, file Form SS-8 with the IRS. This form is for the Determination of Worker Status for Federal Employment Taxes and Income Tax Withholding.

This IRS will review the facts of the situation and officially determine the worker’s status. This determination will help you better understand the difference between W-2 and 1099 pay so you can issue the correct forms to your workers.

For more information on the classification of workers, check out the following resources:

Choosing Who to Hire: W-2 vs. 1099 Workers

Now that you know a little about W-2s and 1099s, you’re probably wondering what type of worker your organization should hire. However, the answer to this question isn’t so simple. You should look to your current talent pool, business needs, and HR recruiting strategy before making this decision.

Both W-2 and 1099 workers can provide valuable skills and knowledge to an organization. It’s also possible to find qualified candidates in both pools. So, here are a few tips that can help you decide which type of worker is right for your business.

- Assess your current talent pool and look for gaps in skill sets.

- Analyze the job market and determine how easy it will be for you to find qualified candidates (Currently, in 2021-2022, the market is competitive for hiring).

- Determine if you need a forever skillset, or you can guy by with shorter-term talent.

- Ask yourself and your managers how fast the worker needs to acclimate. For example, do you need to onboard a full-time employee, or does a freelancer who can immediately start work out better?

- Review your talent budget against currently available candidates. How do the salary and benefits of a full-time worker compare to hiring a contractor or alternative workers?

A Recap

Now that you know the difference between Forms W-2 and 1099, you’re one step closer to choosing the right talent and avoiding tax compliance fees. Remember to review Social Security, Medicare, and FUTA regulations to make the proper income deductions and allocations. Look for upcoming IRS deadlines before handing employees a W-2 or contractors 1099.

If you’re not sure which form to furnish, refer to IRS classifications of workers. If you need to fill a long-term position, consider hiring a full-time W-2 employee. However, consider hiring a contractual worker if you need immediate help in a competitive market.

Determining which form to use and who to hire can help you meet your business needs. Once you review the information above, you can easily make compliance-conscious decisions.

How APS Can Help

APS provides a suite of solutions and services to help you manage compliance and reporting:

- Our secure, centralized database stores and tracks Form W-2 and 1099-NEC for better compliance.

- Our Analytics and Reporting solution provides employee classification reports and reporting for common W-2 errors, so your information is always accurate and up to date.

- Our tax compliance experts help you with the year-end processing of Forms W-2, W-3, and 1099-NEC, saving you time and money.

Sources

- About Form W-2, Wage and Tax Statement

- About Form W-3, Transmittal of Wage and Tax Statements

- What Is an IRS 1099 Form? What It Means, How 1099s Work

- Form 1096, Annual Summary and Transmittal of U.S. Information Returns

- Form 1099-NEC, Nonemployee Compensation

- Instructions for Forms 1099-MISC and 1099-NEC